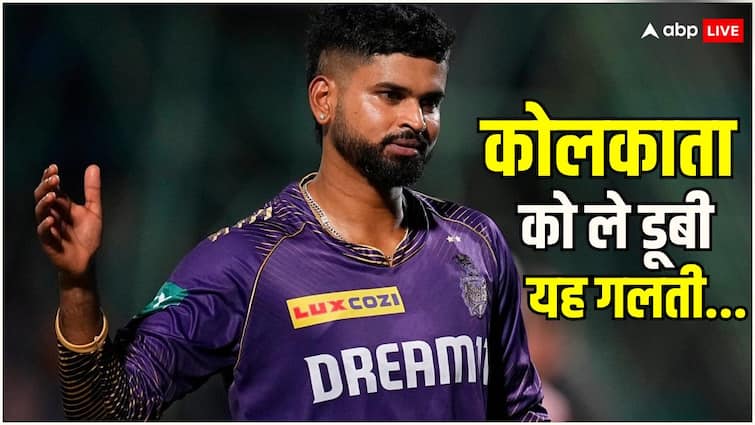

How KKR lost against PBKS after scoring 261 runs while batting first, know the three big reasons for the defeat in IPL 2024

3 reasons for KKR's defeat: Kolkata Knight Riders suffered the most embarrassing defeat in IPL history last Friday (April 26). In the match played against Punjab Kings at Eden Gardens, Kolkata, batting first, scored 261 runs on the board in 20 overs. After this it seemed that KKR would easily win the match, but it … Read more

:max_bytes(150000):strip_icc():focal(749x0:751x2)/sonja-morgan-home01-11252019-35661766264e4e65b666fe6b5d7388e2.jpg)

:max_bytes(150000):strip_icc():focal(749x0:751x2)/jamie-spears-britney-spears-father-100523-tout-2-4115bf94dcc74d27beae0ee736f25bce.jpg)

:max_bytes(150000):strip_icc():focal(999x0:1001x2)/Marla-Adams-042624-64e5d6f6ccc64bc2aef6e3cb762b9652.jpg)